Learn how to use debt to grow your business without straining your finances.

Debt is a powerful tool for your business, providing the necessary capital for growth and expansion. Knowing how to take on debt strategically can fuel growth and expansion. When mismanaged, it can strain finances and threaten long-term stability.

Here’s what you need to know about taking on debt, the difference between “good” debt and “bad” debt, and how to manage debt to grow your business.

How to borrow strategically

Is it ok to have business debt? Yes. Used strategically, debt can be beneficial when funding initiatives that drive revenue or efficiency. It’s important first to assess how the credit will support your business goals.

1. Evaluate your debt needs

Before taking on any type of debt, assess how much is truly necessary. List what you need capital for and how it will contribute to your business. This will help you categorize your needs into “good debt,” used for investments that generate revenue or improve the business, and “bad debt,” which funds nonessential expenses. (More on good and bad debt in the next section.)

For example, using debt to purchase new equipment that increases production capacity or hiring staff to help you run the business are examples of good debt. On the other hand, taking out a loan for new office furniture might not be a priority for your business.

![]()

Tip: If you’re thinking about taking on debt, make an appointment with your Wells Fargo banker. Ask about various business credit options tailored to your business size and industry. Having a greater understanding of potential loan structures can help inform your growth strategy.

2. Pay attention to your credit scores

Borrowing and managing debt builds your business credit profile, which is helpful as your business grows and requires more capital. Both your business and personal credit scores matter when you apply for a small business loan because lenders look at both to see how you have managed debt. Establishing credit with credit cards and lines of credit as well as having a history of on-time payments makes for a strong credit score. Conversely, late payments and a high credit utilization rate (using all or most of your available credit at any given time) can negatively hurt your credit score. Similarly, debt consolidation loans and applying for new credit can temporarily hurt your credit score. However, consolidating debt and making timely payments may improve your credit over the long run.

![]()

Tip: Keep regular tabs on your business using the Wells Fargo Mobile® app¹. You can also check your scores across the major credit bureaus — Dun & Bradstreet, Equifax, Experian, and TransUnion. That way, you can ensure your score is in a good place when you’re considering applying for a loan.

3. Have a payback plan

The most important way to manage debt successfully is to plan for how you will pay back the money you borrow. Review your projected cash flows and ensure you can meet all your obligations, even if your business experiences a rough patch. Wells Fargo offers budgeting and spending tools to help you track your business expense.

Typical sources of debt stress for small businesses can include unpredictable cash flow, rising interest rates, and higher material or labor costs. Having a clear, realistic and proactive payment strategy can help reduce these pressures. This means being able to make more than just minimum payments and integrating debt payment into broader financial management. It’s good practice to ensure your business has enough cash on hand to weather potential downturns.

![]()

Tip: Ask your banker about what repayment terms are available and if payments can be structured so they better align with your revenue cycles.

4. Compare financing options

Your borrowing options depend on how you will use the money, whether it is for short-term or long-term needs and other factors.

![]()

Tip: Your banker can explain how different financing options work and help you pick the right one for your business goals. You can ask which financing program supports your current and future goals and how fees and interest rates compare across options. You can also use Wells Fargo’s Product Selector to choose an appropriate option for your business.

Differentiating between good and bad debt

Good debt. While there is no single definition of good debt, this term usually describes money borrowed to help grow your business. The U.S. Chamber of Commerce describes it as “taking out a loan on an asset that won’t depreciate, such as education [and] real estate.”

Bad debt. On the other hand, bad debt refers to money borrowed to purchase assets that decrease in value, such as office furniture and vehicles, or debt that comes with high fees. Payday loans, merchant cash advances, and similar financing options that seem too good to be true may appear beneficial in the short term but can ultimately lead to financial strain for your business.

How much debt to take on for your business

There’s no single answer for how much debt is the “right” amount. The appropriate amount of debt depends on the size and revenue of your business. For instance, $20,000 could be manageable for some businesses; for others, it may be significant.

1. Understand your debt capacity

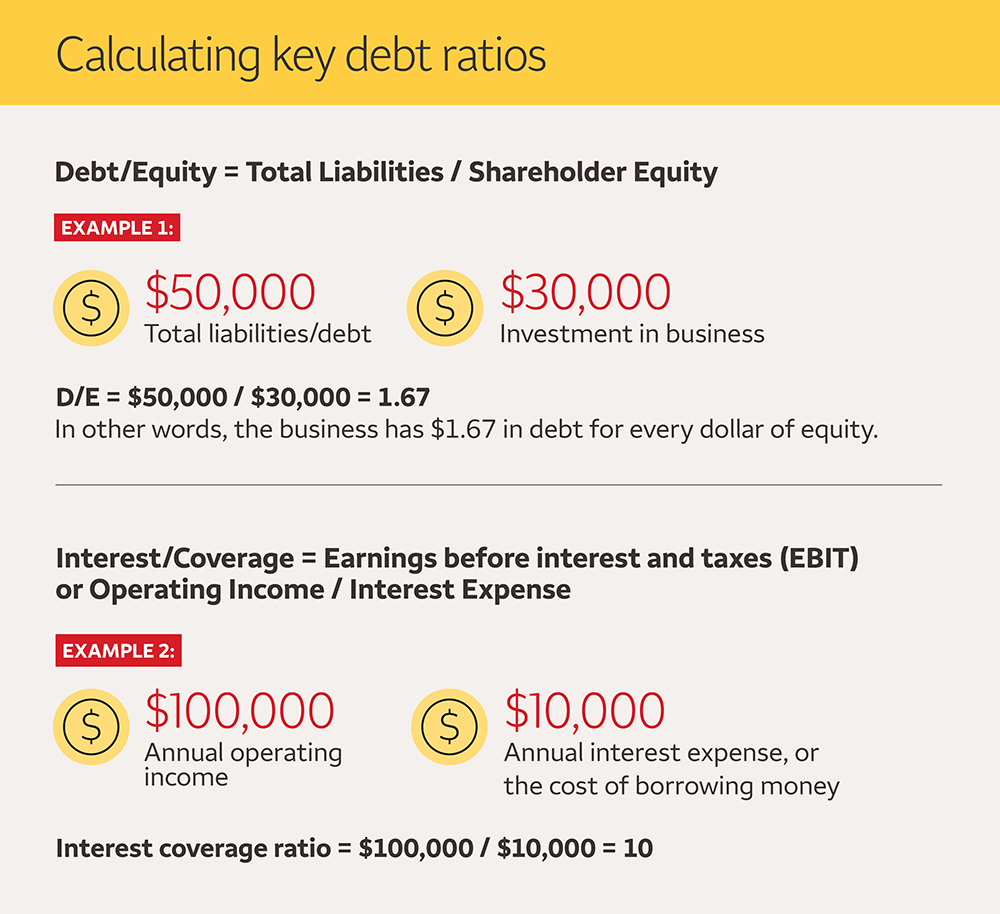

There are methods to calculate how much debt your business can afford to carry. Here are two financial ratios you should know about:

a. Debt-to-equity ratio

This ratio measures how much debt your company has in relation to equity—how much money you and other investors have put into the business. Debts may include small business loans or a mortgage on office space. A lower debt-to-equity (D/E) ratio generally means your business manages debt well. To evaluate your ratio, compare it to others in your industry. Some industries, such as financial services, tend to carry more debt.

b. Interest coverage ratio

This ratio shows whether your business earns enough to cover its interest payments. A higher ratio means you can more comfortably meet your obligations. Generally, an interest coverage ratio of 2 or more is considered healthy—but again, this can vary by industry.

How do you know when you have too much business debt? Calculating both ratios can help you gauge your business’s financial health and understand how attractive it may appear to lenders or investors. A D/E ratio higher than the industry average or an interest coverage ratio below 2 could be a red flag. Ask your banker to help you evaluate your financial ratios and compare them to industry norms.

2. Set realistic debt limits

As you plan for new borrowing, it’s important to set an upper limit on how much debt your business should carry. This limit will depend on your industry, revenue, and growth plans. Capping debt helps you avoid overextending and maintain long-term financial stability.

![]()

Tip: Your Wells Fargo business banker can provide options tailored to your business need.

The bottom line

Debt, when handled strategically, can help drive your business forward. Your banker can be a key resource, helping you evaluate and prioritize business needs, understand and compare financing options, and help you craft a customized borrowing strategy that fits your business and vision.

Take the next step. Schedule a conversation with a Wells Fargo banker to discuss your financing goals and challenges. Ask for a debt capacity review or help in mapping out a debt repayment strategy that supports your business’s growth.

1Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply.

Sources: U.S. Chamber of Commerce, Investopedia 1, Investopedia 2, Investopedia 3