This flexible product can give you access to the cash you need when you need it.

A line of credit can be a valuable option for your business to bridge a cash flow shortfall. When used strategically, it can also be a powerful growth tool. Here’s what you need to know about lines of credit and how to use one to strengthen your business.

What is a business line of credit?

A business line of credit provides fast and flexible access to cash when and where you need it. Unlike a one-time lump sum loan, a line of credit can be used, paid down, and used again multiple times. When you access funds through a line of credit, interest is only charged on the funds you use, and you can choose how much you want to access based on your business needs.

Lines of credit may be secured or unsecured:

- A secured line of credit requires an asset to guarantee the line. So, for example, real estate or another item of value acts as collateral to ensure the loan is repaid.

- An unsecured line of credit does not require such a guarantee.

Source: https://www.fedsmallbusiness.org/reports/survey/2025/2025-report-on-employer-firms

How can your business use a line of credit?

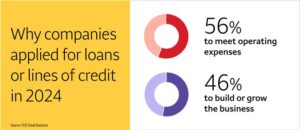

There are several ways you can use a line of credit. For example, a line of credit can be used to cover operating expenses or for investment in or expansion of your business.

1. Covering short-term cash shortages

Cash flow may not be uniform in some businesses. Whether you run a seasonal business that needs to bridge a couple of lean months before income picks up or one of your customers is simply late paying an invoice, a line of credit offers a solution. By accessing cash through your line, you can continue operating smoothly, preserving your business credit history and vendor relationships through timely payments.

2. Maximizing growth opportunities

When opportunity knocks, a line of credit can help you answer. Sometimes, new clients or business expansion will require spending money first. Perhaps fulfilling a big order from a new client requires making a large supply, equipment, or software purchase. A line of credit can provide the influx of cash necessary to make those expenditures and help your business grow or be more efficient.

3. Hiring talent

The right people can make all the difference in how your business operates and, ultimately, how (or if) it grows. However, making an important new hire or adding several new team members to accommodate growth can require some upfront investment. A line of credit can help you meet the salary and benefits needs of the people who will take your business to the next level.

4. Building your business credit

Good business credit may unlock benefits like access to additional financing options, better interest rates, and more favorable terms with trade vendors. Managing a line of credit well and making timely payments can help build your business credit profile, potentially giving your company more financial options.

5. Giving you payment flexibility

A line of credit provides flexibility when paying for products and services. For example, your business may face a range of situations where using a business credit card isn’t possible either because the interest rate is too high or the vendor doesn’t accept credit cards. Since a line of credit may have a higher credit limit than a business credit card and can be used like cash, checks, or electronic payments, it may be a better payment option in some cases.

Exploring a line of credit for your business

Generally, a bank may require a business to have been operating for at least two years to qualify for a line of credit. However, there are exceptions. Because business needs vary, Wells Fargo offers line of credit options designed for both younger and established businesses, with limits ranging from $5,000 to $150,000, depending on the type of line.

As you weigh whether a line of credit is right for your business, be sure to consider:

- Total cost of the loan, including interest rates, which may vary, and fees like annual fee or fees for accessing the funds through an ATM or wire transfer

- Requirements like personal guarantees from or minimum credit scores for owners

Contact a Wells Fargo banker to learn more about lines of credit and to find out which line may be best for your business. To start using an existing line of credit, log in to your account.