You may have more options for boosting recruitment and retention than you think.

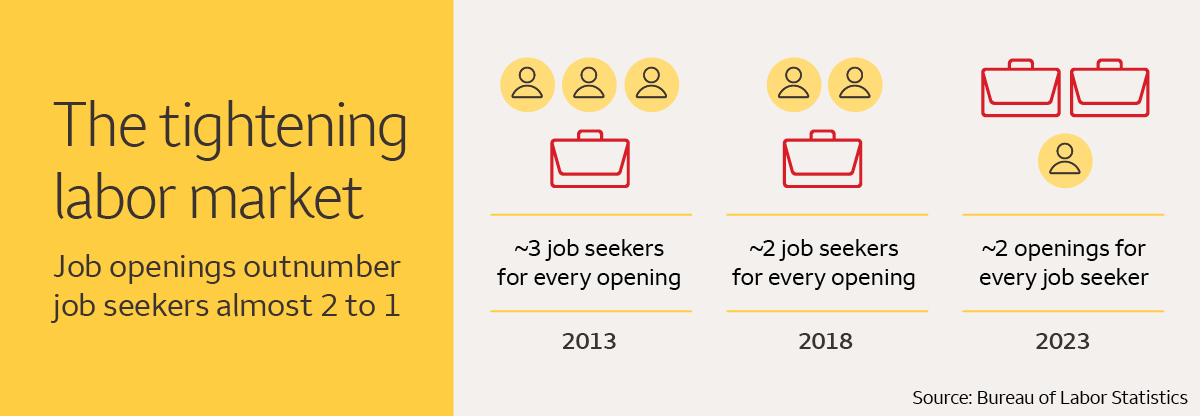

In today’s labor market, there are more job openings than job seekers. But even in these conditions, small businesses — which account for nearly half of all jobs in the United States — can continue to attract and retain top talent by seizing on their unique advantages.

Whether your positions are hourly or salaried, here are four ways to compete successfully with larger corporations to build the best team for your business.

Sweeten compensation with incentive pay

Managing cash flow at a small business can be a delicate act: The greater total expenses you commit to, the harder that act becomes. When competing for talent, you may find that it isn’t always possible to raise starting salaries to match those at larger organizations. In that case, incentive pay, which links the benefit amount to your business’s success, can be an effective way to sweeten a compensation package.

For example, you can offer a stay bonus — a lump-sum payment that rewards an employee for staying with the company for a specific length of time. This incentive is typically calculated as a percentage of salary. However, you may also want to consider how much you’d save in recruitment and onboarding costs by improving retention to find an appropriate figure.

A profit-sharing agreement can also be a great way to invite employees to benefit directly from the performance of the business without gaining an ownership stake.

![]()

Tip: Set your employees up with a profit-sharing plan that lets them share in the success of your business while delivering the benefit of tax-deferred growth potential.

Take advantage of tax credits to build strong retirement and health care benefits

A robust retirement plan is a powerful employee incentive. If it’s been a while since you last looked into setting one up, you may be pleasantly surprised. The SECURE Act 2.0, which became law in late 2022, makes it easier for small businesses to offer retirement plans. The small business start-up credit now covers 100% of administrative costs of a retirement plan (up to $5,000). Another SECURE 2.0 provision allows employers to match their employees’ student loan payments with an employer contribution to their retirement plan.

![]()

Tip: Compare the features of SIMPLE IRA, SEP IRA and 401(k) plans to find the best option for your small business.

Health insurance is another compelling benefit for many employees. If you use the Small Business Health Insurance Options Program (SHOP) to enroll in an ACA-compliant group plan, you may qualify for the Small Business Health Care Tax Credit, which is worth up to 50% of your yearly costs. If you don’t want to set up a group plan, you could instead offer a tax-advantaged health reimbursement arrangement (HRA) to reimburse employees for their health insurance premiums up to a specified amount each month.

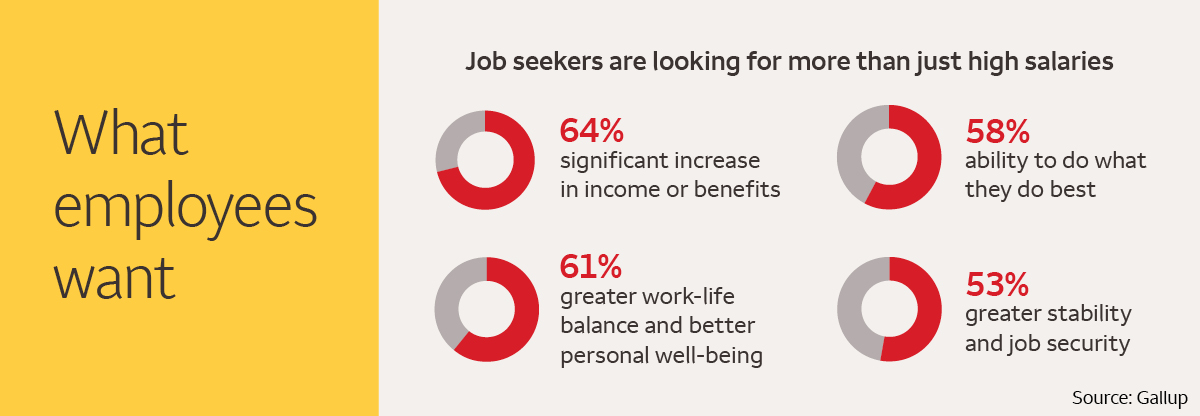

Advertise lifestyle perks

Money is important, but monetary incentives aren’t everything. Work-life balance and well-being are also major motivating factors for job seekers. And you may have more leeway than a large corporation does to add employee incentives such as flexible scheduling or remote work. If so, include these lifestyle perks in your recruitment pitch.

Play to your small business’s strengths

Working at a small business can have many advantages. Employees may be able to:

- Get more individual attention from leaders.

- Have more opportunities to take on additional responsibilities.

- Deal with less organizational hierarchy.

- Know that their contribution has a larger impact on business success than it would at a large corporation, giving them a greater sense of satisfaction.

Development opportunities can be a powerful differentiator, especially when filling a lower-wage position. Working closely with leaders and learning valuable skills along the way can be much more attractive than taking an entry-level position at a large company with a high churn rate and limited employee development.

To build a strong team with high employee morale, seek out prospects who have an affinity for your purpose and business philosophy. Speak sincerely about your mission and highlight unique features of your workplace culture.

![]()

Tip: Consider a workplace design that skips the corporate cubicles and highlights the unique employee experience your company offers.

Many of the same things that inspired you to run your own business — a unique mission, personal empowerment, less bureaucracy — can be just as compelling for prospective employees. By leading with your business’s inherent strengths and taking advantage of opportunities to enhance your compensation package, you can continue to compete for — and win — top talent.

Sources: Bureau of Labor Statistics, Small Business Administration, Thomson Reuters.